Acknowledgements – Output Fields Guide

Acknowledgements are processes in GAIL that are used to send out thank-you letters to your donors. Every school/college/unit has at least one acknowledgement process already established in GAIL. If you, or someone on your team, has not been trained on Acknowledgements, please email Cindy Bond at cmbond@uga.edu to coordinate a training date and time.

The guide provided below is not a substitute for training, this is simply a tool to use as a reference for understanding output fields from GAIL.REMEMBER: Acknowledgements are based on revenue / hard credit / cash in the door and does not include recognition credit or recognition credit individuals.

For clarification between the purpose of each file or report and how/when to use which one, see article below.

Acknowledgements vs Income Summary vs Gift Report // https://support.dar.uga.edu/GAIL/donor-reports-giving-acknowledgements/

Revenue Amount – this is the full amount of the gift/donation, includes every split gift amount.

- Ex: $5,000 gift was submitted and was split between 3 units. $5,000 was the Revenue Amount and the following are the Split Amounts:

- $1,000 went to A&S Fund

- $1,500 went to Presidents Club

- $2,500 went to Business School

Post Date – this is the date the gift was posted in the GAIL system, gifts may be posted in GAIL days or weeks after the donor made the gift depending on how the gift was sent in, postal mail, electronically, etc.

Revenue Date – this is the date the gift was given by the donor.

Anonymous – True/False – this means the gift was made anonymously (do not send a thank you, based on your s/c/u relationship with the donor), or the donor themselves wish to remain anonymous for all their donations.

Deceased – True/False – deceased individuals will be included in your files so that you are made aware of the gift and the gift could have come from their estate. Check for Deceased Spouse as well.

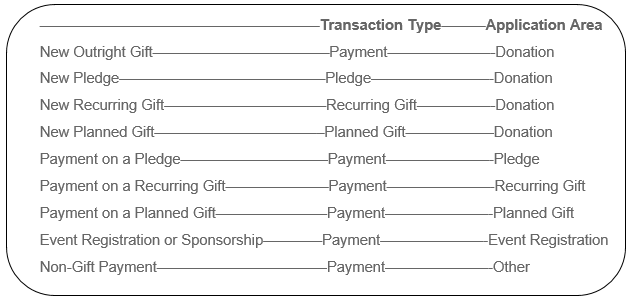

Transaction Type – this indicates which type of transaction the gift was made, Payment, Pledge, Recurring Gift, or Matching Gift. This field is used in conjunction with the Application Area (see chart below).

- Payment on a Donation = straight out gift

- Payment on Recurring Gift = payment has been made on a recurring gift (such as auto-credit card or monthly payroll deduction).

- Payment on a Pledge = payment has been made on a pledge

Community or Family Foundations – watch for these in your export files, if you have a gift show up from one of these organizations or from a business, it is a good practice to research these in GAIL and decide if it’s more appropriate to thank the ‘person’ attached to the gift rather than the foundation or business.

Adjustment Dates – if an older gift appears in your file, it could have already been acknowledged previously so you wouldn’t want to send another letter. The office of Gift & Estate Planning is reviewing all old planned gifts and editing/adding updates which can put these back into your file.

Donor vs Acknowledgee – please be aware that the person getting the acknowledgement letter (acknowledgee) may not be the person that actually made the gift/donation.

Tributes – if the gift was given in tribute of someone, there will be text in the Tribute Text columns to indicate this. In honor of, in memory of.

Prospect Manager Name – if the acknowledgee is assigned a Development Officer as their Prospect Manager, their name will appear in the file as an alert.

Primary Plan Manager – if there’s a prospect plan on the acknowledgee, the name of the primary plan manager will appear, up to 3 plans will be provided.

Revenue Text Note – these notes will be on the Documentation tab of the gift.

- Ex: Donation message: Please continue not to call me at home.

- Ex: Donation message: In honor of Prof Bentley who supported my educational goals.

Special Handling Attribute / Comment – this might contain information such as tribute tag, revenue WF, receipt/acknowledgement, other.

Special Gift Attribute / Value – currently, this would contain information related to the GA Commit Scholarships and/or in relation to matching gifts.

- Ex: GA Commit Shp Match – FY2019

Address Block – this column will include all 3 lines of street address information, to expand, click on the column then click the “Wrap Text” button from the Excel Home menu bar.

Spouse Name – if applicable, this field will populate whether the spouse is living or not – be aware.

(Effort) Mailing name – if donation was made in response to a marketing effort, the name of that marketing effort will appear in this field.

Online Information Page Name – if donation was processed through an online giving or registration page, the name of that page will appear in this field.

Online Information Page ID – this ID field is the unique identifier for the Online Information Page Name.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

IMPORTANT:

** If you must share this data with anyone in your area that is a current UGA employee:

Prior to sharing any GAIL sensitive data, we must have a Non-Disclosure Agreement form on file for this person(s) or this person(s) must already have GAIL access themselves (attended training, etc.)

If you must share this data with a vendor, either a UGA vendor or outside UGA vendor:

Prior to sharing any GAIL sensitive data, we must have a Non-Disclosure Agreement form on file for this vendor.

Forms can be found by clicking this link: https://support.dar.uga.edu/GAIL/ask-it/

** If you are sharing GAIL data file, you must use the designated secure email client offered by EITS called SendFiles. No other email service is approved. Instructions for using Sendfiles can be found by clicking this link: https://support.dar.uga.edu/GAIL/sending-documents-in-sendfiles-2/